Are you Dreaming of owning a bike but cannot afford it all at once? We all know that purchasing your two-wheeler can be so fulfilling. You can easily travel from one location to another on your terms and conditions instead of always booking a cab for looking for rickshaws.

Try taking a bike loan to help you to be the owner of your dream bike very soon! Here are some of the best agencies for bike loans along with their eligibility criteria! In this article, we have tried to cover the Top 5 Best Agencies for a Bike Loan in India. Check them out below.

1) IDFC FIRST Bank

Taking loans from IDFC first bank can be a great option because you can take a loan of 95% of the value of the vehicle and pay just 5% at the beginning. The best part is that they offer a tenure that is flexible enough to run up to 5 years.

They provide you with an easy process of application that can be done online in just a few minutes. The bank is also physically present in more than 65 locations across India so that you can continue this process face to face too. The IDFC first bank is transparent enough to share every detail with you about your bike finance. As soon as you are eligible to avail of a bike loan, they sanction the loan as soon as possible on EMI and immediately transfer the amount of your loan to the dealer of your bike.

IDFC FIRST Bank has a great network of branches across the country. You can find the IDFC FIRST Bank branch address and contact details at https://www.dealerservicecenter.in/list/bike-loan/idfc-first-bank.

2) Hero Fincorp

Another agency that offers a bike loan is Hero Fincorp. To avail of a loan for two-wheelers, it is important to be at least 18 years old or above. You need to be working for a one-year minimum. It could also be your own business what it is important to be in the same position for at least six months. You should have all the documents like identity proof and address proof along with your passport size photograph and salary slips.

Taking a loan via Hero Fincorp, you can avail interest rates that are low along with a tenure that runs for a long period of up to 48 months. The company offers you attractive interest rates along with minimal documentation required. They process your bike loans seamlessly and as soon as possible making your task much easier.

The loan repayment terms are also flexible enough. One can pay via cash, PDS, NACH, ECS, etc. The speed of processing the loan is super-fast, a maximum of two days.

You can find the Hero Fincorp branch address and contact details at https://www.dealerservicecenter.in/list/bike-loan/hero-fincorp.

3) Bajaj Finserv

Bajaj Finserv has been offering some of the best policies for bike loans. The eligibility criteria for getting a bike loan from Bajaj Finserv is given below:

- Your age should be at least 21 years old from the day you apply for application and make sure that towards the end of the term your age should be no more than 65 years.

- You need to be residing in at least one City for at least a year.

- Also, you should be working for a minimum of one year.

- Also, you need to have a landline number. This landline number can either be a residential one or an office number.

Visit any nearest Bajaj Finserv branch to get a vehicle loan at attractive interest rates. You can locate the nearest Bajaj Finserv branch to apply for a vehicle loan here at https://www.dealerservicecenter.in/list/bike-loan/bajaj-finserv.

4) Incred Finance

Incred incredible terms for bike loans with attractive interest values. To be eligible for a loan via InCred, you have to fall in the given criteria:

- You have to be earning a minimum of one year to be eligible for a bike loan. There is no compulsion to be earning on a salary basis or being self-employed.

- Your age should be above 18 years or at least a minimum of 18.

It is easy to avail of a bike loan via InCred online through their website. You just have to fill up a simple form and once you are verified to be eligible, the bank will send a call by its representatives to carry forward the process of the loan. Also, the best part is that you can also process a loan at the showroom of your two-wheelers. How? The answer is that Incred representatives come up to the showroom and process your loan then and there.

You can search for the nearest Incred branch to apply for the vehicle loan here at https://www.dealerservicecenter.in/list/bike-loan/incred.

5) Indostar Capital Finance

Indostar Capital Finance helps an entrepreneur who is planning to start or expand the transportation business.IndoStar Capital Finance helps in vehicle funding requirements. The loan agency has specially tailored-made programs to cater to every need of customers. Moreover, they also provide engine or tyre replacement loans.

Key Features of Indostar Capital Finance Bike Loan:

- Loans for new and used vehicles.

- Easy documentation, quicker processing, and faster disbursements

- Up to 100 percent loan of the vehicle value

- Up to 60 months loan tenure

- Attractive interest rates, a simple, fast, and transparent process

- More than 322 branches of Indostar Capital Finance across the country

Indostar Capital Finance Branches

Walk into your closest Indostar Capital Finance branch and get a vehicle loan with easy documentation. The list of Indostar Capital Finance branches all over India is given at https://www.dealerservicecenter.in/list/bike-loan/indostar-capital-finance.Required Documents for Bike Loan

Given below is a list of documents that you will require for any bike loan:

- A copy of your Identity proof like Adhaar Card, Passport, Voters ID card, Driving License.

- A copy of your Address proof.

- Income Proof.

- Passport Size Photographs

- Salary Slips

If you are looking to buy a tractor, here is a detailed guide for Tractor Loan: Top 5 Agencies for Tractor Loans in India | Find Office Address in India.

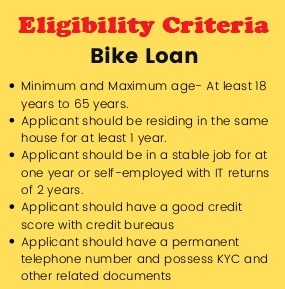

Eligibility for a Two-wheeler Loan

If you are looking for a two-wheeler loan, look into this image. You must fulfill some basic eligibility for the two-wheeler loan.

Conclusion

With the necessary documents and a stable income, one should easily avail of a loan. There are multiple agencies and banks providing vehicle loans at attractive rates of interest. This article will be beneficial to choose the best vehicle loan agency.

Hope you’ll find one. Happy reading and stay tuned for more articles like this.

Hope you’ll find one. Happy reading and stay tuned for more articles like this.

Nice

good

Feedback / Review